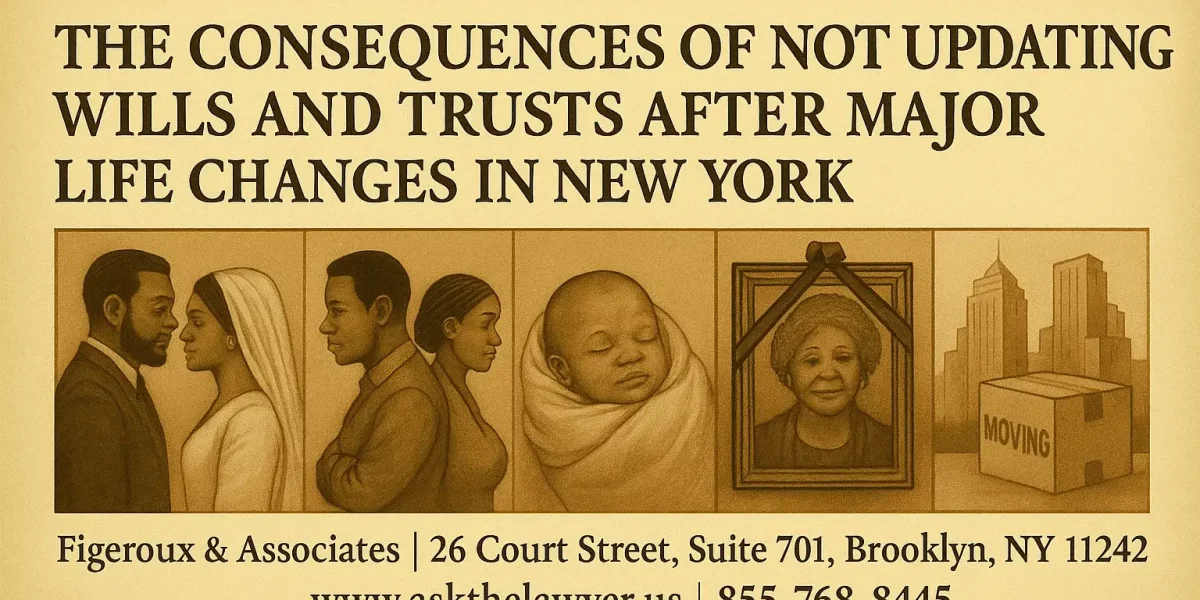

Legal Analysis: The Consequences of Not Updating Wills and Trusts After Major Life Changes in New York

Photo Copyright IQ INC. Figeroux & Associates | 26 Court Street, Suite 701, Brooklyn, NY 11242 | www.askthelawyer.us | 855-768-8845 Creating a will or trust is a critical step in protecting your family and your legacy — but estate planning isn’t a one-and-done task. At Figeroux & Associates,...

Read more